What is a Loan Against Shares?

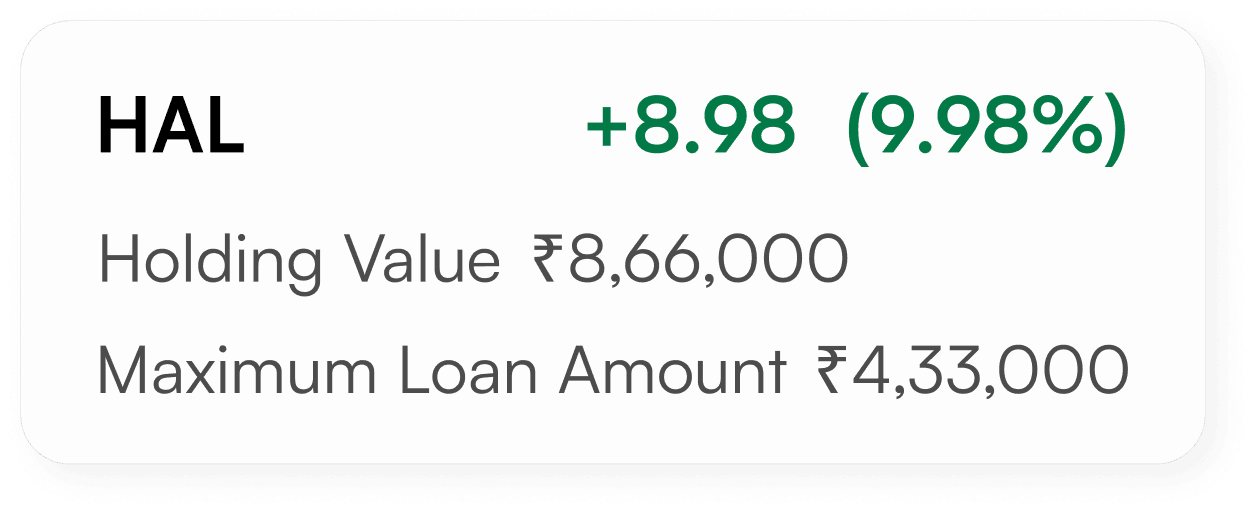

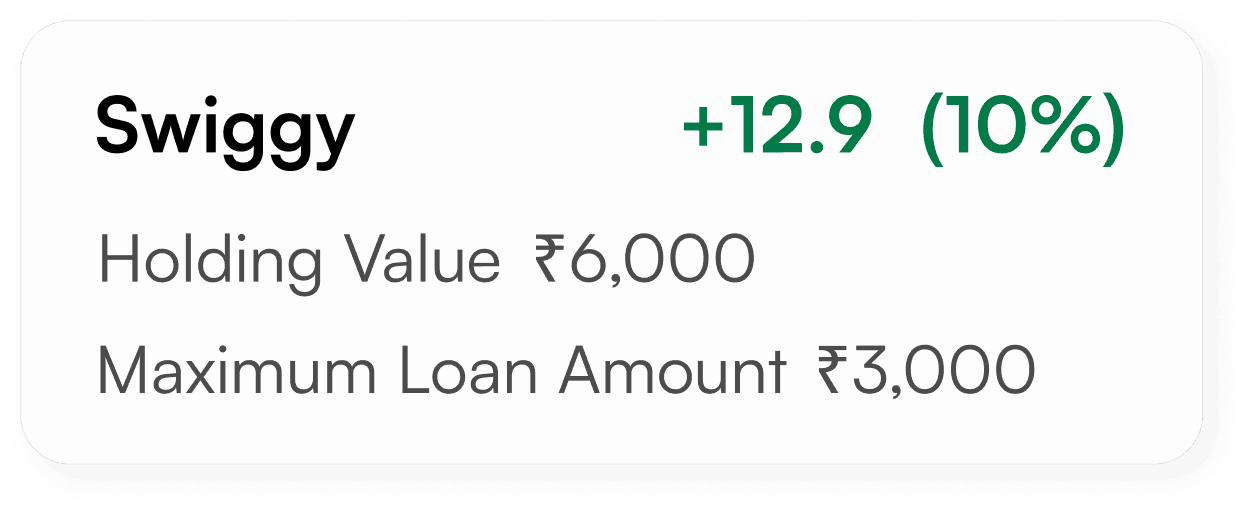

A Loan Against Shares (LAS) lets you pledge your shareholdings as collateral to access cash. You don’t need to sell your shares – so they remain invested, continue earning returns & dividends, and you get liquidity when you need it.